Here are some checks you can do that may help you identify an unrecognised transaction.

Understanding your transactions

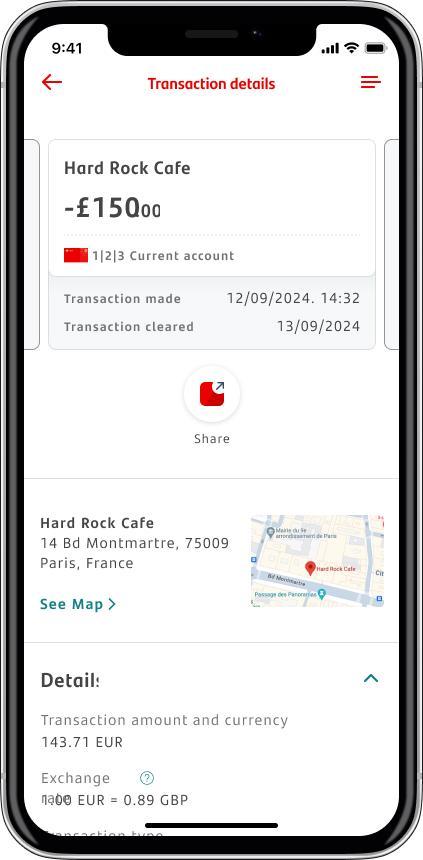

In our Mobile Banking app you can see:

- the date and time of when the payment was made

- the location, which will show as a map or text, if there's enough information available

- fees incurred (such as exchange fees, transaction fees and cash machine fees).

Follow the steps below to learn how to find the details of a card transaction in Mobile Banking.

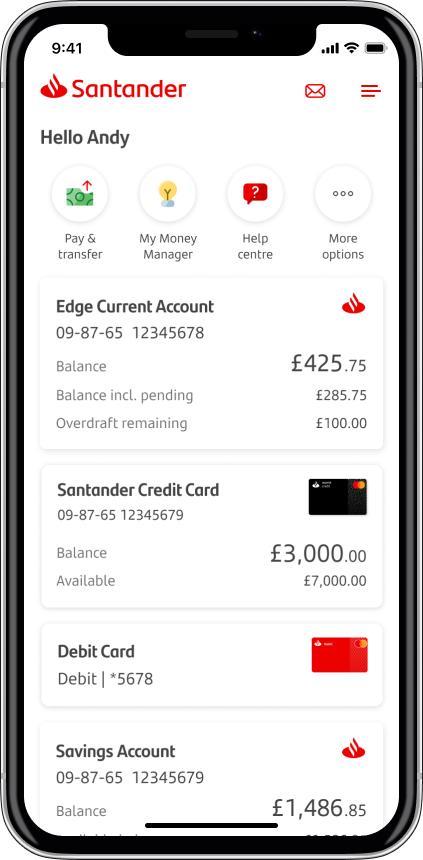

1

Tap the card you’d like to learn more about

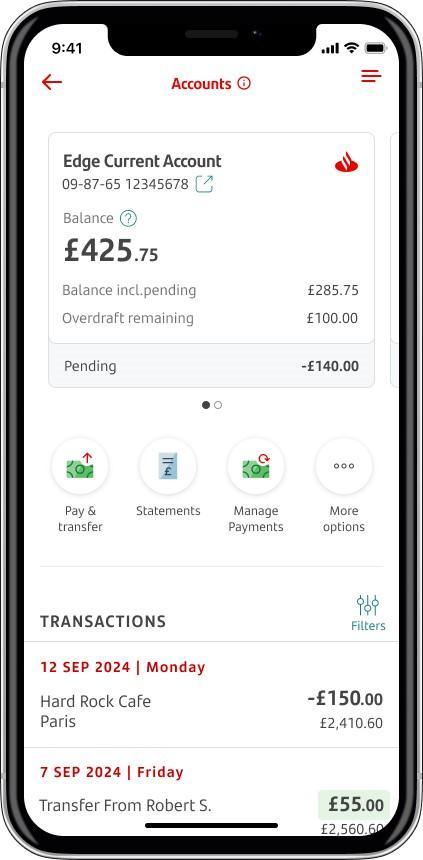

2

Tap on a transaction to see more information

3

You’ll see the details about your transaction

If you're using Online Banking, you can download our Mobile Banking app. You can log on with the same details you use for Online Banking.

If you haven't signed up for Online Banking yet, you can get started today.

We've added some new features in Mobile Banking to help you stay on top of your card payments and transfers.

- You can see the status of a payment in the 'Payments cleared' section. It will say 'Pending' until the payment's cleared and later tell you the settled date.

- For international transactions in a currency other than £, we'll show you the exchange rate.

- You'll see the location of a transaction to help you see where it came from. If there's enough information, we’ll show you a map or address.

Ask another account holder

Check to see if anyone who has access to the account has made the transaction.

Pending transactions

A pending transaction is a recent transaction you've made that hasn't been fully processed yet. You can look at your pending transactions on Mobile or Online Banking. When you’re logged on, choose which account you want to check your transactions for. Pending transactions will show at the top of the list.

You’ll need to contact the merchant or seller to ask them to cancel a pending card payment.

If you need help with a payment that is not pending, you can visit our card dispute page.

Check for ongoing subscriptions

Many online services use a subscription plan. This means they'll automatically bill you after an initial free or discounted period ends. Check any services where you've subscribed but haven't cancelled.

If you see a transaction you don't recognise from a retailer that you know, check with them before you speak to us.’

For more information on payments like this, please see our future-dated card payments page.

Check the exchange rates

If you buy something in a foreign currency, the exchange rate conversion might show a different amount in sterling.

Check the business name

Some business names might look different on your statement to the one you expect. This is common with online services. You can use a search engine to look up the name that shows on your transaction. This is a good way to check if it’s connected with a business you recognise.

Here are some examples of unrecognised transactions.

| Unrecognised company | What could it be? |

|---|---|

| A2Z Loans | A credit broker that charges a fee for its services. |

| AD.Bone-Fish.Com | An online dating service. |

| ADMIRAL.COM | A car insurance provider. |

| Adrian Flux Insurance | An insurance broker covering cars, from classic and vintage to heavily modified sports cars. |

| Adyen | Electronic payment processing company. |

| agelessapothecary.com | A beauty and supplements subscription service. |

| AlcudaBill | Billing service for online dating services. |

| All About Prizes | An online discount membership scheme. |

| Allpay | A payment service used by some public and private sector organisations. This includes councils and housing associations. |

| Amazon Digital SVCS | A digital download from Amazon. |

| Amazon Prime | Membership for Amazon's TV, films and next day delivery services. |

| AMZ*Prime | Amazon Prime, Amazon's subscription service. |

| Applegreen | Fuel and service stations. For example, Shell, Esso and other petrol stations. |

| Arcadia | A holding company name for fashion brands. This includes Burton, Dorothy Perkins, Evans, Miss Selfridge, Topman, Topshop, Wallis, BHS and Outfit. |

| ARCHIVES.COM | An online subscription service for tracing family histories. |

| Ariste Holding Ltd | An online lender providing cash advances for short-term money needs. |

| Ask Ziinga | An auction website. |

| Ask Zinga | Penny auction site that charges following a trial fee. |

| Audible.co.uk | An audiobook subscription service owned by Amazon. |

| AVG Internet Security | An anti-virus and internet safety software product. |

| B365 Internet | Bet365, an online gambling company. |

| B365 Internet / Bet365 | Sports betting app and website. |

| Badoo | A dating app and social networking website. It’s free to use, but there are additional services you can pay for. Similar to Tinder, Bumble or Plenty of Fish. |

BCW | BCW debt collection company. |

| Betfair | An online betting company. |

| Betfred | A betting company. |

| BFL (Paysafe) | Big Fat Lotto. An online lottery syndicate. |

| Big Savings Club | Online discounts and vouchers for paying members. They might offer a free trial to begin with. |

| bilablau.com | An online department store. |

| Camelot Group | Operators of the UK National Lottery. |

| Capita | A payment service used by a number of public and private sector organisations. This includes TV licences. |

| Cash 4 u Now | An online lender that provides cash advances for short-term money needs. |

| Cash Locator | An online credit broker that charges a fee for finding loans. |

| CASH4UNow | Payday lender. |

| Cassava | An online betting and gaming website. |

| Cassava Enterprises | 888.com and Wink Bingo. |

| Castle Finance Direct | A loan application website. They charge you for referring you to lenders. |

| CHB | Child Benefit. This is part of the government welfare service. |

| Chequeless | An online lender that provides cash advances for short-term money needs. |

| CI Ltd | A betting company trading as 'Coral’. |

| Completesave.co.uk (WLY*COMPLETESAVE.CO.UK) | Complete Savings UK. A monthly membership for an online savings programme that starts out as a free trial. |

| Credit Angel | An online service for checking your credit report. |

| Credit Cleaner | An online service for checking your credit report. |

| Credit Expert | A membership service for your Experian credit report and score. This might start with a 30 day free trial. |

| Credit Reports Matter | An online service for checking your credit report. |

| Creditconfidential.com | An online service that offers you access to your credit report and rating for a monthly membership. This may start with a 15-day free trial. |

| CreditHub* | An online service for checking your credit report. |

| CreditPerfect | An online service for checking your credit report. |

| CX – Loyalty | Complete Savings, a cashback company. |

| Unrecognised company | What could it be? |

|---|---|

| Domestic & General | Provide warranties for domestic appliances from companies such as Curry’s. |

| DRI*AVG | Anti-virus software subscription. |

| ECOMMWEBHOST.COM | A website creation and hosting company. |

| EE | Telecoms company. Brands include Orange and T-Mobile. |

| Epoch.com | Epoch provide payment services to online merchants, including adult entertainment sites. |

| Equifax Ltd | A credit reporting company. They offer a membership service which allows you access to your credit report and score. This might start with a 30-day free trial. |

| Expedia | An online travel booking company that owns several travel brands. This includes Hotels.com, Trivago, Hotwire, Egencia, Venere, Travelocity, Orbitz and HomeAway. |

| Experian | An online service for checking your credit report. |

| G I Ltd | A UK betting shop, bingo and casino operator. Their biggest brands are Gala Bingo and Coral. |

| GB Discounts | An online membership that charges a monthly fee for access to offers, discounts and vouchers. |

| GI Ltd | A betting company with brands such as Coral and Gala Bingo. |

| Giffgaff.Com | A mobile phone network (owned by 02). |

| Global Personals | Operators of online dating and social networking websites. This includes Dating Republic, Dating Agency, Love2Meet and Singles 365. |

| Goldex Inv | A franchise owner for Costa Coffee who run cafés in the South-East of England. |

| GOOGLE PLAY | A digital download from the Google Play Store. |

| Grattan | An online catalogue retailer, selling fashion, home and garden products. |

| H3G | Company name of the mobile network, Three Mobile. |

| Haven Holidays | A family holiday park operator. |

| Hertz Ltd | A car and van hire company. |

| Home Bargains | A discount retailer owned by TJ Morris. |

| Home Retail Group | A holding company that own brands including Argos and Homebase. |

| HomeLet | Barbon Insurance Group Limited. A UK tenant referencing and specialist lettings insurance company. |

| HOMESERVE MEMBERSHIP | A home emergency cover provider. |

| Hutchison 3G UK | Three Mobile, a telecoms company. |

| Ideal Shopping Direct* | An online shopping channel. |

| Indesit.co.uk | Supplier of home appliances and white goods. |

| iTunes | A digital download from Apple iTunes. |

| Juice Plus | A dietary supplements company. |

| Just Eat | An online food order and delivery service between take-out food outlets and customers. |

| Kingfisher | Owners of B&Q and Screwfix. |

| Knowhow | Curry's technology support. |

| Knowhow (TEAM KNOWHOW-CLOUD) | Technology servicing, repairs and support service. Sold at Curry's, PC World and Carphone Warehouse. |

| Unrecognised company | What could it be? |

|---|---|

| LAITHWAITES WINE | A subscription service for wine deliveries. |

| LBK | Ladbrokes. This is a betting and gaming company. |

| Lending Stream | A short-term lender offering lower value loans. |

| LeOr Skincare | A beauty product subscription service. |

| Let's Go Rewards | An online discount membership scheme. |

| Littlewoods | An online catalogue retailer. They often offer repayment options. |

| Live Career | CV support service. |

| Loan Marketing | A credit broker that charges a fee for its services. |

| Loan Rocket | A credit broker that charges a fee for its services. |

| Loan Spotter | A credit broker that charges a fee for its services. |

| LOVEFiLM By Post | A DVD rental service owned by Amazon. |

| Lowcostholidays | A holiday company which has ceased trading. |

| Lowell Group | Debt recovery service mainly for businesses. |

| MadBid.Com | An online auction site. |

| Magnum Pay | Payment service used by health supplement businesses. |

| Magnum Pay2Z Loans | A credit broker that charges a fee for its services. |

| Match.com | An online dating service. |

| MBNA | A credit card provider. |

| McAfee | Anti-virus and internet safety software company. |

| MCAFEE *INTEL SECURITY* | A virus and internet security protection product. |

| MICROSOFT *OFFICE* | A suite of services including Microsoft Word, Microsoft Excel and Microsoft PowerPoint. |

| MICROSOFT *XBOXLIVE* | A purchase made through a Microsoft Xbox account. |

| MIGHTY DEALS | A website providing regular discounts on various products and services. |

| Mobile Finder | A mobile phone network broker that charges a fee for its services. |

| MoneyPlus Group | An online lender which purchased Clear View Finance in 2014. |

| Mr Lender | Short-term lenders. The trading name of PDL Finance Limited. |

| My Credit Tracker | Credit support services in exchange for a monthly fee. |

| Nakedwines.com | A subscription service for wine deliveries. |

| Netflix | An online streaming service for TV and films. You might get a free trial, that follows on with a monthly fee. |

| New Day | Providers of credit and store cards. Brands include Debenhams, House of Fraser, Laura Ashley, Wallis, Burton, Dorothy Perkins, Evans, Harvey Nichols, Miss Selfridge, Outfit, Topshop and Topman. |

| Norton | Anti-virus and internet safety software company. |

| NOWTV.COM | An online subscription service for streaming TV programmes and films. |

| Nutrajump | An online retailer of health and beauty products. |

| NW Card Services | NatWest’s credit card services. |

| NWBS | Nationwide Building Society. |

| NYA | A card payment made at a vending machine. |

| OUTDOOR EXPERIENCE TEI | An outdoor clothing and equipment retailer. |

| Unrecognised Company | What could it be? |

|---|---|

| Paddy Power | Online betting website. |

| Payday Express | An online lender that provides cash advances for short-term money needs. |

| Payday UK | An online lender that provides cash advances for short-term money needs. |

| Payforit | A brand that allows customers to make payments using their phone, on behalf of several mobile providers. |

| PayPal | An online payment service which supports bank transfers. This can be a checkout option for online retailers such as eBay, Amazon and others. |

| Payref.info | They manage payment services for online dating websites. This reference is usually related to a subscription. |

| PLENTYOFFISH | An online dating service. |

| Pounds to Pocket | Short-term lender, who offer small loans. |

| Premium Credit | A loan provider. |

| Product Support AG | An after-care service for products purchased from Curry's PC World. |

| Qmee | Third-party provider that offers cashback for internet searches and signing up to online offers. |

| Quick Credit Score | Online membership that provides access to your credit information for a monthly fee. |

| Quick Quid | A short-term lender, who offer payday and short term loans. |

| RAC | A roadside assistance service and car insurance provider. |

| Rewards Now | A membership programme offering discounts on retail brands. After the initial free trial, you pay a monthly subscription. |

| Shopperdisc | An online discount membership scheme. |

| Sony Ent Network | Sony Entertainment Network. Charges could relate to a PlayStation Plus membership, or purchase of a game. |

| Spotify | A music streaming service with both free and paid services. |

| Sunny | An online lender that charges interest daily. |

| Telefonica | A telecommunications company that includes mobile network providers such as O2. |

| TfL | Transport for London. If you use public transport in London, including the Underground, Overground, buses, or trams, this might show on your statement. |

| Ticketmaster | A ticket purchasing service for theatre, concerts and sporting events. |

| UK Credit | Online lending company. |

| Venntro Media Group | An online dating service. |

| Viagogo | An online marketplace for buying and selling tickets to live events. |

| Virgin Wines | A subscription service for wine deliveries. |

| Virtual MaSerIRL | 888.com or Wink Bingo. |

| Wage Day Advance | An online lender providing cash advances for short-term money needs. |

| Weight Watchers UK Ltd | A subscription service for weight loss. |

| WHO Internet | William Hill Online Betting, an online betting company. |

| WLY* SHOPPERDISC.CO.UK | Shopper Discounts & Rewards – they charge a monthly fee in exchange or discounts on online retailers. They start charging once a 30-day trial period ends. |

| WLY*COMPLETESAV | Complete Savings UK, an online savings programme. |

| WLY*COMPLETESAVE.CO.UK* | An online discount membership scheme trading as 'Complete Savings’. |

| WLY*MYTIMEREWARDSWL.UK* | An online discount membership scheme trading as 'My Time Rewards’. |

| Wonga | Short-term lender, offering payday and short term loans. |

| WWW.DCDIGITALTV.CO | An online electrical goods retailer. |

| Xbox Live | Something bought through an Xbox account. |

| Xsolla | A video game company. |

| Zoosk | An online dating service. |

| Unrecognised company | What could it be? |

|---|---|

| 118118 Beauty | A beauty club subscription service. |

| 121money.com | A credit broker that specialises in short-term borrowing. It currently trades under SupaLoans. |

| 247 Moneybox | An online lender providing cash advances for short-term money needs. |

Still need help?

If you still don’t recognise a transaction after these checks and think this could be fraud, you can report this in the Mobile Banking app. Or if you don’t have the app, you can contact us.

Already reported an unrecognised transaction? View our mobile guide for step-by-step instructions on how to track your claim in the mobile app.