What is a stocks and shares ISA?

An ISA is an Individual Savings Account. A stocks and shares ISA (also called an investment ISA) is an account that you can use for your investments.

You can invest tax-efficiently, meaning there’s no UK income tax or capital gains tax for you to pay.

[On screen message: Remember, the value of any investment can fall, as well as rise, so you may get back less than you invest. Tax rules can also change, and any benefits will depend on your individual circumstances.]

A stock and shares ISA is a type of individual savings account, also known as an Investment ISA.

It’s a type of tax wrapper that can be put around your investments.

These ISAs give you many of the tax benefits of a cash ISA but with the edge of potentially higher growth over the medium to long term.

Meaning you won’t have to pay any UK income tax or capital gains tax on any money you earn.

To invest in your stocks and shares ISA, you can keep it simple by choosing one of our ready-made investments or choose from funds across the market.

Or if you are not sure, you can get person to person investment advice.

Stocks and share ISAs are better suited for money you can put away for 5 or more years, giving them the chance to grow and overcome dips in the stock market.

How much can you pay into an ISA?

For the 2025/26 tax year, you can save up to £20,000 in cash ISAs, Stocks and Shares ISAs, innovative finance ISAs and a lifetime ISA. Your ISA limit can be paid into multiple ISAs of the same type, except the lifetime ISA, each tax year.

You can only invest £20,000 or under across all ISAs. What you don’t use doesn’t roll over.

If you want to invest more, you can use our Investment Account.

How can a stocks and shares ISA benefit me?

A stocks and shares ISA is effectively a 'tax wrapper' that can be put around investments. This means you don’t pay capital gains tax on the growth of your investments and there’s no tax on any income you receive.

How to an open a stocks and shares ISA

To invest in a stocks and shares ISA, you need to choose what to invest in. Santander has a simple set of ready made investments or you can pick your own. Then, pick how much of your yearly ISA allowance you want to use. This can be a lump sum or regular amount of money each month, starting from as little as £20.

You can open a stocks and shares ISA on our Investment platform called the Investment Hub.

You can open a stocks and shares ISA if:

- you’re 18 or over,

- you’re a UK resident for tax purposes.

If you’re not feeling confident about investing yourself, we offer specialist advice from our qualified Financial Planning Managers.

It's just a few simple steps to open your stocks and shares ISA

1. Choose your investment

To invest in a stocks and shares ISA, you need to choose what to invest in

- Santander has a simple set of ready-made investment funds

- Or you can choose from a wide range of other funds from across the market.

2. Pick your allowance

Choose how much of your yearly ISA allowance you want to use

- This can be a lump sum, starting from as little as £100

- And/or a regular amount of money each month, starting from £20

3. Open an account

Open a stocks and shares ISA on our Investment platform called the Investment Hub

- You can only open a stocks and shares ISA if:

- You’re aged 18 or over

- You’re a UK resident for tax purposes

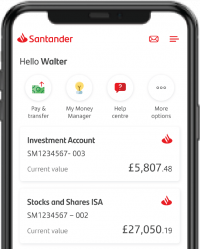

Stay on top of your investment on our app

Keep you in control

Whether you want to check your investments online or through the app we have you covered.

- Watch how your money performs with your mobile, tablet, or laptop

- Make changes easily online or through the all

New to Santander? Download our app on the app store or Google Play.

If you already have the app, hit menu, product and offer, and then investments to get started.

As with all investments your capital is at risk and you may get back less than you invest. Investments should be held for the medium to long term (5+ years), unless there is a fixed term that applies.

The tax treatment of your investment depends on your individual circumstances and may be subject to change in the future.

Learn more about investing, from how to get started to different ways of investing

If you're looking for a simple and tax-efficient way to save for the future, a stocks and shares ISA is an excellent option. You can start investing with a lump sum of £100 or £20 per month.

You can transfer your cash ISA with Santander or other providers into a stocks and shares ISA.

Keep in mind, for Santander Stocks and Shares ISAs, the ISA manager is Santander ISA Managers Limited. This means that transfers between Santander Stocks and Shares ISAs and Santander cash ISAs should be treated as transfers between ISA providers and can take up to 30 days for monies to come across.

All investment providers charge a fee for using their investment platform. We have a clear charging structure.

You can transfer in ISAs you have with other providers at any time.

It can take up to 30 days to receive your monies from when we receive your request to transfer funds.