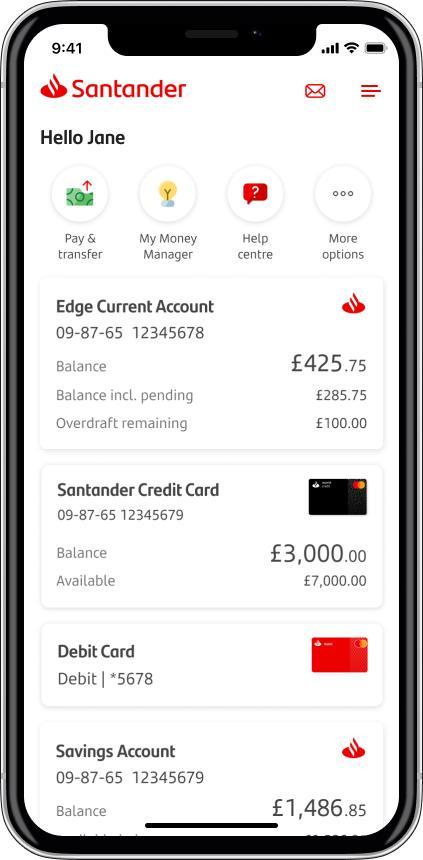

You can see your statements in the Mobile Banking app and Online Banking.

What is paper-free?

Going paper-free means that you'll get your statements and other important notices online and not by post. We can’t show you everything in Mobile and Online Banking yet. So, for now, depending on the accounts you have with us, we may still send you some notices in the post. We have 9.2 million Santander customers who are paper-free and are seeing the benefits.

Going paper-free has many benefits for you:

- Peace of mind, knowing your statements and notices are safely stored online.

- See your account activity from the last 7 years.

- Get an email when there's a new statement or notice to look at.

- Download and print your statements and notices when you want.

- Easy access to your accounts from wherever you are.

- Reduce paper waste.

How to go paper-free

Once you go paper-free, you can download and print your statements whenever you want. If you change your mind, you can update your preferences at any time.

In Mobile Banking

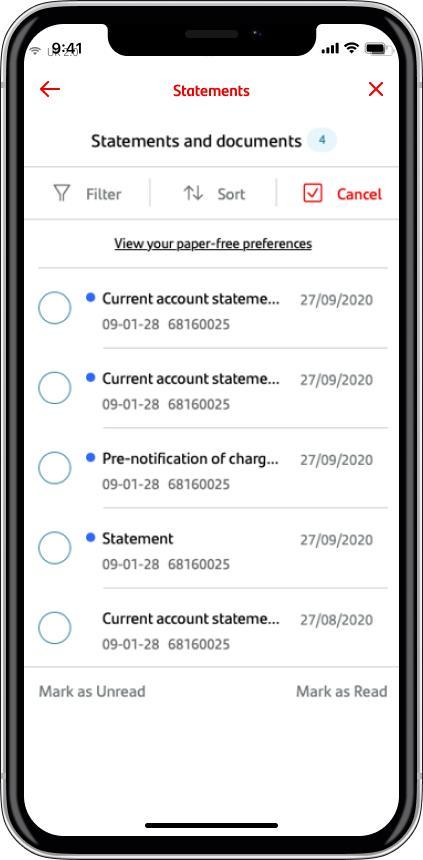

An easy way to go paper-free is through our Mobile Banking app. Simply log on and follow these 3 steps

1.

Tap 'Mailbox' in the top-right corner and then 'Statements and documents’

2.

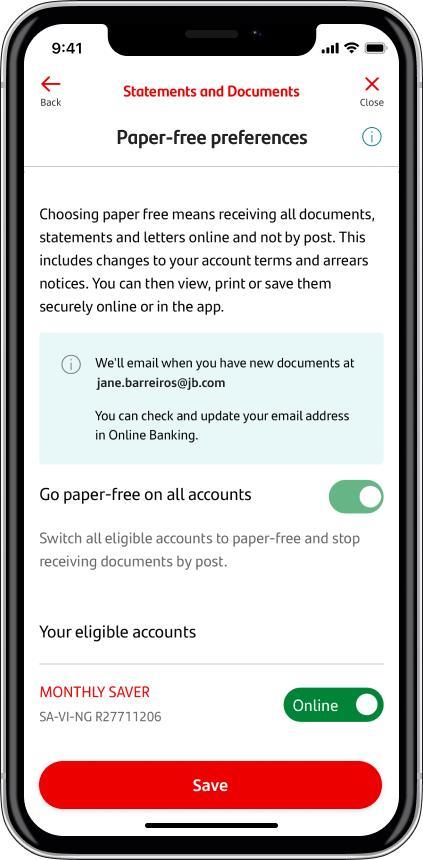

Then choose ‘View your paper-free preferences’

3.

You can choose to go paper-free on all your accounts or only on some

Once you click 'Paper-free preferences', you can go paper-free on some or all of your eligible accounts. You can change your preferences any time you like.

If you're using Online Banking but don't have our Mobile Banking app, take a look at our Mobile Banking Guides to see how the app works and what else you can do in it. For step-by-step instructions on how to view your statements and documents see our mobile guide

Print using our Mobile Banking app

To print off a statement in Mobile Banking, click ‘Mailbox’ in the top-right corner and then ‘Statements and documents’. To download it, tap on the download icon in the top right corner of the screen. Once you’ve downloaded the PDF, you can print the document.

In Online Banking

You can also go paper-free in Online Banking.

- Log on to Online Banking.

- Click the ‘Account services’ at the top of the page.

- Click ‘Paper-free preferences’.

- Choose ‘Go paper-free on all accounts’ or pick each of your eligible accounts.

Print using Online Banking

To print in Online Banking, log on and click ‘Statements and documents’, then choose the document you’d like to print off and click the print icon.

If you don't have a printer, you can order a paper copy using Chat in Mobile or Online Banking by typing 'order statement'. Alternatively, you can contact us

You can sign up for Online and Mobile Banking if you haven’t done so already.

Can’t log on to your account? Visit our trouble logging on page for help and tips.

Other ways to bank

You can use our cash machines to check and print balances and mini-statements showing a list of your most recent transactions. Visit our branch locator page and use the filter to find your nearest cash machine.

You can also register to get free account alerts to keep you updated with what’s happening with your accounts.

What's a statement period?

Current accounts

A statement period runs from the monthly anniversary of the date you opened or transferred your account. For example, if your statement date is the 18th of the month, your monthly statement period will cover the period from the 18th of one month until the 17th of the next. This may be different if you've asked for it to be changed.

Where we talk about a month in relation to your account, we're referring to the monthly statement period. Where we talk about paying cashback monthly, or ask you to fund the account each month, we mean the monthly statement period.

Savings accounts

The statement period is typically annual. The month you get your statement may depend on the savings account you opened.

How do we provide statements?

Paper-free accounts

Some of our accounts are paper-free or online-only. This will be in the eligibility criteria. Once the account has been open for at least 24 hours, you can update your account settings to start receiving statements by post.

If you're paper-free, your statements will be stored in e-Documents within Mobile or Online Banking. You can find out how to go paper-free and manage your statements online with our Online Banking guides.

Non-paper-free accounts

For any other accounts you'll get paper statements unless you've chosen to be paper-free. You'll receive a paper statement by post monthly for current accounts. We may provide you with paper statements once every 3 months. You can choose whether to receive paper statements once a month or once every 3 months. Just let us know in branch or by contacting us. For savings accounts you'll typically receive a paper statement by post once a year. Your statements will also be available in your e-Documents in Mobile or Online Banking. If regulation or the law asks us to, we may send you statements at different times to the ones you ask for.

All banking and savings accounts

We offer free one off or monthly paper statements on request. There is a charge for weekly paper statements. Information on transactions is available at your convenience in Mobile and Online Banking. If you give us an email address we'll send you confirmation of when your statement is ready to view online. You can switch between paper and paper-free statements at any time in Mobile or Online Banking.

Understanding your statement

Your statement will include:

- your account name

- any interest rates that apply to your account

- your account balance

- details of any transactions that you've made

- any interest that has been credited to your account

- information about the fees and charges you may have incurred

To help you understand how it works, take a look at our Managing your money (PDF - 894 KB) leaflet.

Non-statements

Current accounts

We'll contact you about any overdraft related charges or fees in any monthly statement period. This will be in advance of the fees being taken from your account.

Savings accounts

We may contact you with details of a transaction. This will only be where a receipt isn't available at the time (for example, telephone transfers).

We’re working towards making all our products eligible to be paper-free. Those that are currently eligible for paper-free will be shown in your preferences, and as we make more products available, they'll appear there too.

What if I need paper statements in the future?

Switching back to paper statements is just as easy as going paper-free.

You can access your documents whenever you like in Mobile and Online Banking.

For step-by-step instructions on how to manage or print your statements from our Mobile Banking app, take a look at the mobile demo

In Online Banking:

- log on and click ‘Account services’

- choose the document you’d like to print

- click the print icon and choose your printer.

Alternatively, you can request paper statements through post or download and print them using our Mobile Banking app or Online Banking.

Our electronic statements no longer have a watermark on them. They’re the same as the statements you get in the mail.

Tax statements

You'll get your account summary to view as an e-Document in Online Banking. You'll get this in either May or June each year. We recommend registering for Online Banking if you haven't already. If you've got a bond, you'll get your summary in May or June as well. We'll send this to you as a document in the post.

Account summary (available in May)

You'll get the details of any interest paid on your personal savings, current accounts, and bonds during the tax year all in one place. This summary includes open and closed accounts from 6th to 5th April from the previous tax year. We'll aim to make these available by the end of May.

You can view and print your account summary in Online Banking.

Bond account summary (sent in May)

If you have an open bond, you'll get also get an account summary. This will give details of any interest paid for bonds you have open as of 5th April for the previous tax year. It also gives you an annual reminder of The Financial Services Compensation Scheme (FSCS) limits. Closed or matured accounts are not included. This document will not be available online or by request.

Mortgage statements

You get a statement at the beginning of every year. It shows your mortgage details. This includes your current interest rate and mortgage balance. It also shows a summary of your last year’s payments.

It’s easy to go paper-free for your annual mortgage statement in Mobile Banking or Online Banking.

You can also view and manage your mortgage in Mobile Banking and Online Banking at any time.

If you have a Flexible mortgage, we’re sorry you can’t get a paper-free statement at this time.

Personal Loan statements

You can view the details and transactions of your personal loan in Online Banking and Mobile Banking

Every year we'll send you a paper statement confirming the details of the repayments you've made. You'll get this on the anniversary of the date you opened your loan. You can view your statement at any time on Online Banking. This will show you how much you've repaid, and the amount left to repay.

You can ask for a copy of your annual loan statement or an ad hoc statement by contacting us if you need to. Make sure you have your loan account number, sort code, and know the date range you'd like to check as well. There's no charge for this service, and the statement will be sent out to you by 2nd class post.