Understanding your overdraft

An overdraft is borrowing through your current account. This is a short-term borrowing method, and you are charged when you use it. It can give you a bit of extra money for urgent, unexpected costs that might come up. But remember, it can be expensive compared to other ways to borrow.

- We’ll do a credit check when you apply for an arranged overdraft. We’ll let you know if you can have one, and how much you can borrow.

- An overdraft must be paid back when we ask you to. This is in line with our General Terms and Conditions.

- It's important to remember that different current accounts have different overdraft interest and charges.

- Head to our current accounts page to find out more.

There are other ways to borrow, such as loans and credit cards, which could provide cheaper alternatives depending on your personal circumstances. A full list of borrowing options can be found here

Arranged and unarranged overdrafts – how they work

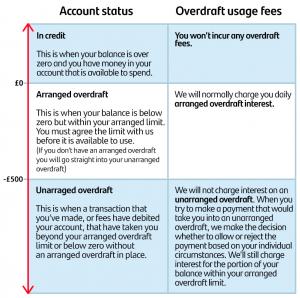

An arranged overdraft is when your balance is below zero but within an arranged limit. That means you're borrowing money from us. You must agree the limit with us before it's available to use.

An unarranged overdraft is when your account:

- goes over your arranged overdraft limit, or

- has a balance below zero without an arranged overdraft in place.

When you try to make a payment that would take you into an unarranged overdraft, we decide whether to allow or stop the payment based on your personal circumstances. If we let the payment go through, it will take you into an unarranged overdraft. We don’t charge fees for allowing or refusing a payment due to lack of funds.

Here’s an example of how it works for a customer with a £500 arranged overdraft (your specific fees may vary)

Below you will find some advantages and disadvantages of using an overdraft:

| Advantages | Disadvantages |

|

|

If you're unsure whether you're eligible for an overdraft, you can use our Eligibility Checker to see whether you're likely to be accepted for one. Is the eligibility checker right for me?

Existing customers

If you have a current account with us and would like to apply for an overdraft, you can apply by:

- logging on to Online Banking

- clicking ‘My accounts and transactions’

- choosing ‘Manage overdraft’ on the left-hand side of the page.

If approved, you’ll be sent a One Time Passcode (OTP) to authorise this change and your overdraft will be available to use right away.

Alternatively you can visit your local branch with 2 forms of identification or contact us

New customers

If you haven't got a Santander current account and would like to open one, you can apply for an overdraft at the same time. Take a look at our full range of current accounts for more information.

Credit checks

Using an overdraft is borrowing, or getting into debt. Because you're asking to borrow from us, if you ask for a new overdraft or overdraft extension we'll check your financial history with the three main credit agencies. This is called a credit check. If we ask for a credit check on you but don't give you an overdraft or overdraft extension, our request will stay on the files that the credit agencies keep on you.

Online and Mobile Banking

One of the best ways to stay on top of your accounts is to check your balance regularly. Online and Mobile Banking helps by letting you access your banking wherever you are. As long as you have internet access, you can log on to see your balance and what payments have gone in and out of your account.

If you'd like more information about understanding overdrafts, statements, how to manage your money, setting up account alerts and more, please read our Managing your money leaflet (PDF - 894 KB)

Account alerts

We'll send you free alerts when:

- you make a payment that may take your account into an unarranged overdraft

- you make a payment that may take your account into an arranged overdraft

- we intend to refuse a future payment due to a lack of funds

- we refuse a payment due to lack of funds.

We’ll send these alerts before your account's charged so you have time to pay in money to avoid or reduce these charges. We’ll send these alerts by text, push notification, and/or email, so it’s important you tell us if your mobile number or email address changes.

You'll be automatically registered for these alerts. You can manage your alerts settings at any time by using Online Banking. For more information, visit our account alerts page.

Need more help? Please contact us or visit your local branch

If you need help managing your money or if you’re in debt, please visit our money worries page.

Time to manage your account

If you use an arranged or unarranged overdraft, you'll have until 8pm that day to credit your account with cleared funds and move your balance back into your Arranged Overdraft or into credit and avoid interest.

If you’d like to increase or decrease your overdraft limit, you can do this by:

- logging on to Online Banking

- click on ‘My accounts & transactions’

- click ‘Manage overdraft’ on the left-hand side

- choose the relevant account

You can increase or decrease your overdraft in multiples of £50.

Please remember to check your current balance before applying to reduce or remove your overdraft. If you decide to do this and your account is using its arranged overdraft, removing or reducing your arranged overdraft could put your account in an unarranged position. This could lead to refused and rejected payments and bills. Staying in an unarranged overdraft could also affect your credit score in the long term.

Reducing or cancelling your overdraft facility

An overdraft has no specific end date, which means it will continue until either you tell us you no longer want it, or we give you notice that we're reducing it or removing it in full.

If you’d like to cancel your overdraft facility, you can do this by:

- logging on to Online Banking

- click on ‘My accounts & transactions’

- click ‘Manage overdraft’ on the left-hand side

- choose the relevant account and enter new limit as 0 and click ‘Continue’

Alternatively, you can contact us

You can see exactly how much your overdraft will cost you using our cost calculator.

If you’re not sure how much overdraft you’ll use, the table shows how much you’ll be charged

if you use exactly £500 of your arranged overdraft.

If you borrow more than this or for a longer period, the cost will be higher.

Overdrafts are intended for short-term use and emergencies. If you think you’ll need to borrow money for a long time, check our borrowing options page to learn about other products we have.

More details on our interest can be found on the web pages for each current account. If you have an account which is not mentioned on this page, please visit our cost calculator page for overdraft charges or important information for accounts no longer available to open page for further account details.

What are you charged for?

If you have an arranged overdraft with us, we’ll normally charge you interest for each day you use it. If you go beyond your limit, you won’t be charged any interest on the portion of the balance that's above your limit. However, you’ll still be charged interest on the portion of your balance within your limit.

We'll let you know about any charges on your monthly statement or by letter if you're registered for quarterly statements. These will include details of the transactions that caused the charges and the date they'll be taken from your account. You don’t need to do anything more, as they’ll be automatically taken from your account.

- Sign up for free text messages to stay up-to-date on your account.

- Make use of budget planners, which compares how much you earn with how much you spend. And help you see where you could save money. They can be found by searching for ‘budget planner’ on santander.co.uk.

- Use Online and Mobile Banking to quickly check your account balances on the move.

- View our range of current accounts, some of which may charge less for using an overdraft than you’re currently paying. It’s quick and easy to transfer to a different account in our range.

- Borrowing money in different ways, which could be by using a credit card or taking out a loan. Make sure that any borrowing method you use is both affordable and suitable for your needs.

- Don’t go over your arranged overdraft limit.

- Stay up-to-date with any changes to your current account or overdraft, including fees.

- Remember that anything you spend from your overdraft will need to be paid back.

Having trouble paying your overdraft or other debts?

It's easy to feel overwhelmed by finances, especially if times are tight. Writing down exactly what you have coming in and out of your account could help you to figure out where your money is going.

Try filling in a budget planner to see what your spending looks like then come and talk to us in your local Santander branch if you'd like help with any of your accounts, overdrafts, loans or credit cards.

If your account is mostly or always overdrawn, we class this as repeat overdraft use. This could indicate that you’re experiencing financial difficulties. We’re here to support you through these difficult times.

There are other ways we can support you managing or reducing your overdraft, here are a few examples of how we can help:

- Repayment plan – This is an agreement to make regular payments in order to repay your unarranged overdraft balance. We’ll suspend your interest and fees during the time of the agreement.

- Monthly Reducing Overdrafts - We can make a plan to help you gradually pay off your overdraft balance. We'll work with you to make sure it's affordable, and we might agree to put interest charges on hold for a while. This would let you clear the overdraft balance while still using your account.

- Breathing space – This gives you time to contact a third party to develop a repayment plan. We’ll suspend any interest and fees during this time.

- Paydown – This is a monthly repayment amount which clears the overdraft. We’ll block the account so you won’t be able to use it.

We tailor these support options to your individual circumstances once we’ve done an affordability assessment with you. Any agreements in place will impact your credit file. We’ll continue to share account performance updates with an arrangement flag to the credit reference agencies, but speaking to us about your options won’t impact your credit file.

We also have some helpful information on managing your finances on our help with managing my money page.

Below are some examples of overdraft usage and how transactions and interest may be processed.

If you'd like some more information about understanding overdrafts, statements, how to manage your money, setting up account alerts and more, please read our 'Managing your money' leaflet (PDF - 1.39 MB)