Good times to come for investors?

What do rate changes mean for me?

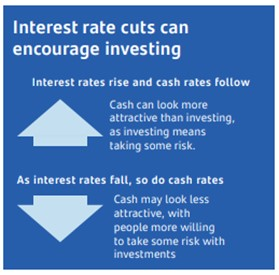

When the Bank of England lowers the base rate, borrowing money becomes cheaper. This means if you’re looking to take out a loan for a car, or a mortgage on a house, you’ll pay less interest. On the other hand, you’ll earn less interest on your savings. So, the money you have in a savings account won’t grow as quickly. This might encourage you to look for other ways to grow your money that could offer a better return.

It’s not just homebuyers and borrowers who count on falling interest rates. Investors eagerly anticipate them too. Markets tend to look ahead to the future, rather than what might be happening today. Cheaper borrowing costs can help businesses grow because they can take out loans at lower interest rates. This can lead to higher profits and, in turn, higher stock prices. So, investing in the stock market might become more attractive.

Investing vs cash

Over the last 25 years, investing has seen dramatic ups and downs. From the dot.com bubble to financial crises, and even the COVID pandemic – these have all caused the markets to change.

More recently, cash has become more attractive with higher rates. However, the rates have already started to fall and this is set to continue over the next few years.

If the past is anything to go by, cash tends to offer much lower long-term returns when compared to investments – especially when you factor in both inflation and tax.

Given the ups and downs of the past 25 years, here’s a simple approach to start investing

Start small

Begin by investing as little as £20 a month. As you gain confidence and experience, you can gradually increase the amount you invest.

Pick simple

Consider investing in simple ready-made investments. Which one you pick will depend on how much risk you’re able, and willing, to take.

Be patient

Investing is a long-term game. Don’t get discouraged by short-term market fluctuations. Stay focused on your long-term goals.

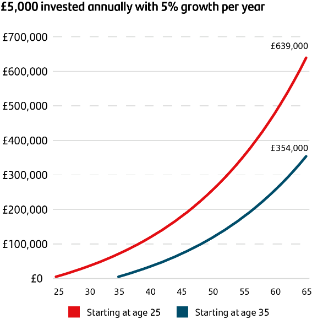

The sooner you start, the better

Delaying the start of your investment journey can make a big difference. Starting as soon as you can, means you’ll give your money more time to benefit from the power of compounding.

Investing options tailored to your needs

Invest in yourself

Choose your own investment

Buy, sell and manage your investment online.

Financial advice

Get investment advice to suit your needs from one of our Select Investment Advisers.

As with all investments your capital is at risk and you may get back less than you invest. Investments should be held for the medium to long term (5+ years), unless there is a fixed term that applies.

The tax treatment of your investment depends on your individual circumstances and may be subject to change in the future.