Investing can be a good way to grow your money, but where do you begin? With so many ways to invest, it can seem far from simple to get started.

That’s why we keep it simple with a range of ready-made investments.

The benefits to ready-made investments

- Simplicity: Ready-made investments have different risk and reward levels to help you choose whats right for you.

- Managed for you: Experts create and manage these funds, so you don’t have to.

- Low cost: Our low fees help you grow your money.

- Start from £20: invest regularly from £20 per month or from a £100 lump sum, or do a bit of both.

Planning for our financial future can feel overwhelming at times

The choices we make now can have a significant impact on our future financial well-being.

Investing is about trying to make your money grow over the long-term

To do this you need to take some risk.

So depending on what you feel you can afford the risk you are willing to take and the financial goals you are trying to achieve, the readymade my wealth funds would be a simple place to start.

Our experts at Santander Asset Management manage the readymade funds by deciding what to invest in and when so you don't have to.

The four funds; Cautious, Moderate, Balanced and Progressive each have a different mix of investments to target different levels of risk over the long term

For example the Cautious and Moderate funds have a greater focus on defensive Investments such as bonds and cash.

The Balanced and Progressive funds have a greater focus on growth investments such as shares and higher risk bonds.

So no matter what you're saving for investing in a ready-made solution such as the mywealth funds is a great place to start.

You can invest online or in Branch.

My wealth seeks to help customers achieve their investment goals.

What are ready-made investments?

They are off the shelf selections of funds, managed by experts, making investing simple and hassle free. The easy choice if you don’t have a lot of time or are new to investing. Instead of choosing individual stocks or bonds yourself, you can pick the ready-made box you are most comfortable with.

Or you can pick and mix from hundreds of individual funds to make your own box.

As with all investments your capital is at risk and you may get back less than you invest. Investments should be held for the medium to long term (5+ years), unless there is a fixed term that applies.

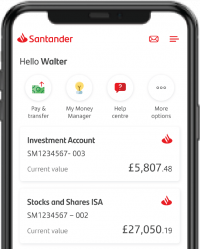

Stay on top of your investment with our app

If you already have the app, hit menu, product and offers, and then investments to get started.

Whether you want to check your investments online or through the app we have you covered.

- Watch how your money performs with your mobile, tablet, or laptop

- Make changes easily online or through the app

New to Santander? Download our app from the iOS App Store or the Google Play Store.

No, these boxes are designed and managed by the experts to keep you on track with the risk style.

Our team at Santander Asset Management. They have a wealth of investment experience, presence across multiple markets and billions invested. They are experts in what they do.

We charge an annual platform fee to provide a secure place to invest, transact, and manage your investments. Each fund manager also charges a fee for running the fund.