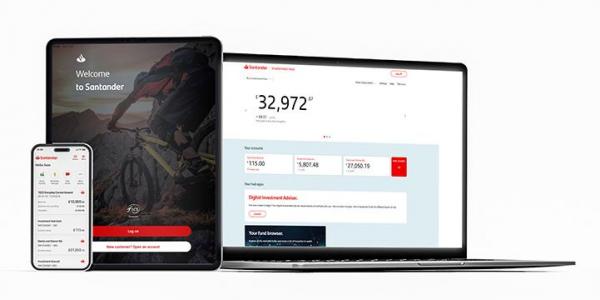

Our offer has closed but we do have a simple way to start investing

Ready-made investments

To make investing simple, we have 4 ready-made funds, created by our financial experts. Simply choose which best suits your investments needs.

- Open a new or top up an existing Stocks & Shares ISA.

- Invest at least £100 lump sum or £20 a month into a stocks and shares ISA.

- 50 winners in each prize draw with a range of cash prizes from £100 to £1,000.

- Three prize draws between 18/02/25 and 31/05/25.

- Cash prizes paid directly into your Investment Hub Cash Account.

As with all investments, your capital is at risk, and you may get back less than you invest. Investments should be held for the medium to long term (5+ years).

The tax treatment of your investment depends on your individual circumstances and may be subject to change in the future.