‘Your Mortgage’ Best Online Mortgage Lender 2025 - 2026

Whether it’s your first home, a new move, or remortgaging to us, you can count on us to get things sorted.

Why not get the ball rolling today?

You may lose your home if you don't keep up with your mortgage payments. Applications are subject to status and lending policy.

Juggling credit cards can be messy. Transferring the balance to us isn’t.

With our balance transfer credit cards, you could save by moving balances you’ve got on credit cards elsewhere.

24.9% to 29.8% APR representative (variable) depending on the credit card. Fees may apply. Credit is subject to status.

Sip, snack, save!

Get a £5 e-voucher when you get a quote for home insurance to spend at Costa Coffee, Starbucks, Deliveroo or Just Eat.

Cover provided by Aviva. T&Cs apply. Offer can be withdrawn at any time.

Support for Personal customers

Financial support

Products

Customer support

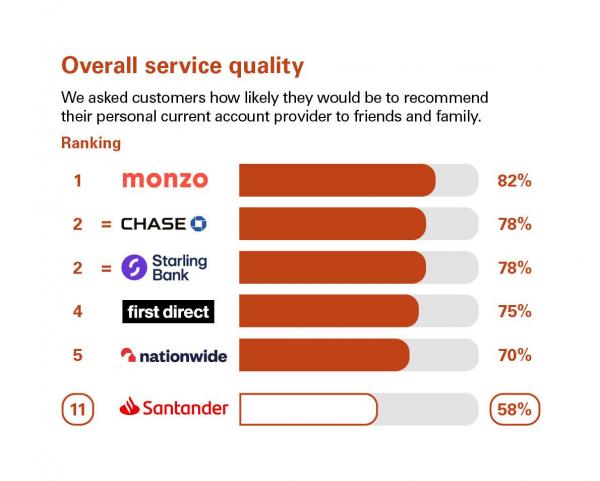

Independent service quality survey results

Personal current accounts (GB)

Published August 2025

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Take a look at the latest published results

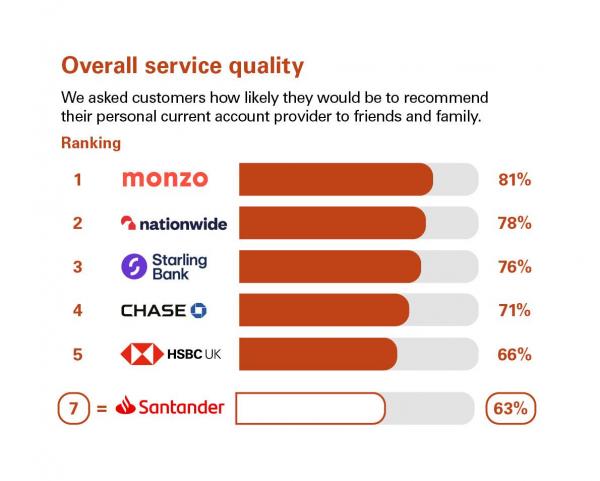

Personal current accounts (NI)

Published August 2025

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 12 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Take a look at the latest published results

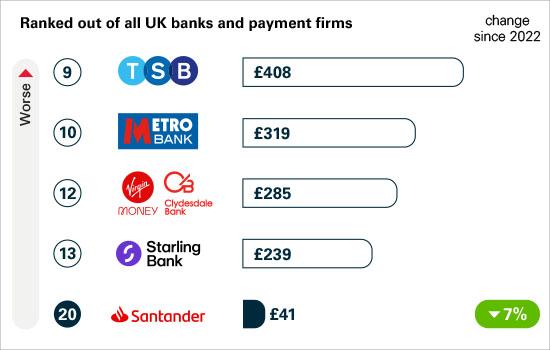

Authorised push payment (APP) scams rankings in 2023

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator by major banking groups in the UK in 2023.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

Share of APP scams refunded

This is the proportion of total APP fraud losses that were reimbursed, ranked out of 14 firms.

APP scams received per £million transactions: smaller UK banks and payment firms

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

APP scams sent per £million transactions

This is the amount of money sent from the victim’s account to the scammer, ranked out of 14 firms. For example, for every £1 million of Santander transactions sent in 2023, £162 was lost to APP scams.

APP scams received per £million transactions: major UK banks and building societies

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at Santander, £41 of it was APP scams.