Our Santander Edge current account comes with

Cashback on your bills

1% cashback (up to £10 a month) on selected household bills when you pay by Direct Debit

Travel benefits

We won’t charge you for using your Santander Edge debit card outside the UK – Learn more in the ‘Travel’ section below

Cashback on your essential spend

1% cashback (up to £10 a month) at supermarkets and on travel costs when you use your debit card (exclusions apply)

Arranged overdraft

Short term borrowing for those unexpected costs. Subject to status – learn more about overdrafts in the ‘Overdrafts and charges’ section below

Use our calculator to find out how much you could earn in cashback and interest with the Edge current account.

Plus, exclusive access to

How it works

- Pay a £3 monthly fee to maintain the account

- Pay at least £500 into your account each month

- Have 2 active Direct Debits

- You’re over 18 and live in the UK permanently

- You might need to provide proof of id, such as photo ID or proof of your address.

This is a paper-free account – learn more in ‘Key documents and account information’

We have two current accounts in our Santander Edge range – Santander Edge and Santander Edge Up. To check which one’s right for you, compare the accounts

Account details

Account fee

The Santander Edge current account includes a monthly fee and an overdraft option.

There’s a £3 monthly fee to maintain the account. It’s paid from your account automatically each month.

The Fee Information Document (PDF - 128 KB) explains the main fees and charges for this account, including those for using an overdraft.

To learn more about some of the common terms we use, take a look at our glossary

Overdraft

An overdraft lets you borrow through your current account. It’s intended mainly for short-term costs or emergencies and isn’t generally suitable for longer-term borrowing. There is a cost associated with using an overdraft. The way you manage your overdraft, for example if you don’t repay your interest and charges regularly, may affect your credit file. This could make it harder or more expensive to get credit with us or other providers in the future. Find out more about overdrafts

Overdrafts depend on your circumstances. You must repay any overdraft when we ask, in line with our General Terms and Conditions. We may ask you to repay all or part of your overdraft at any time. We'll try to notify you of this in advance.

An arranged overdraft is when we let you borrow up to a pre-agreed limit. You can ask for one when you open your account or at any other time.

An unarranged overdraft is when your account goes overdrawn without an arranged overdraft in place or if your account goes over your arranged overdraft limit.

When you try to make a payment when you don’t have enough money in the account, we decide whether to allow or reject the payment based on your circumstances. If we allow a payment, it’ll take you into an unarranged overdraft. We don’t charge fees for allowing or refusing a payment due to lack of funds.

Am I eligible? How much will it cost?

Is the eligibility checker right for me?

Already completed the eligibility checker? You can retrieve your previous decision

The table below shows you how you’ll be charged for using your overdraft.

| Arranged overdraft interest and charges | Representative 39.94% APR/ EAR (variable) |

|---|---|

| Unarranged overdraft interest and charges | Representative 0% APR/ EAR (variable) |

How does our overdraft compare? We show a representative APR so you can compare the costs of different credit products.

If you’re switching to us from another bank, you won’t be charged arranged overdraft interest for the first 4 months.

Representative example

If you use an arranged overdraft of £1,200, you’ll be charged an interest rate of 39.94% APR/EAR (variable). Actual credit limit may differ.

We offer other current accounts with different overdraft interest rates or without the option for an overdraft facility. We also have different borrowing options, such as credit cards, personal loans, and additional loans for our mortgage customers. Learn more about our borrowing options

There are other charges with this account. Please see our terms and conditions for details.

Overdraft alerts

You’ll get text alerts when:

- your account makes (or may make) use of an unarranged overdraft

- you have regular payments due on your account and you don’t have the funds to cover them

- a payment is refused as you don’t have enough funds

- your account goes further into an arranged overdraft, which may cause the cost to increase.

We’ll send these alerts before your account’s charged so that you have time to pay in money and either avoid or reduce overdraft charges. Make sure your mobile number is up to date so we can send these to you.

You can also register for other account alerts to help you to stay on top of your finances. For example, alerts to let you know when your balance has fallen below a set limit, or if you’ve had a deposit into your account that’s greater than a set amount. For more information, visit our account alerts page.

You can manage your alerts settings at any time by using Online Banking. If you’d like more help with this, please contact us or visit your local branch.

If you need help managing your money or if you’re in debt, please visit our money worries page.

International and CHAPS payments

- You can make international payments with no extra fees from us. The bank receiving the payment may still apply charges.

- There’s no charge for making CHAPS payments from your Santander Edge current account.

You can earn 1% cashback on:

- some household bills, when you pay them by Direct Debit, and

- some supermarket and travel costs when you pay with your Santander Edge current account debit card.

| Household bills | |

|---|---|

| 1% cashback | Council tax bills Mobile and home phone bills Broadband and paid-for TV packages Gas and electricity bills Water bills |

Cashback isn’t paid on TV licences, LPG or Calor gas, maintenance contracts (e.g. boiler repair cover) or for commercial use.

Find out which suppliers you can earn Direct Debit cashback with.

| Essential spend | |

|---|---|

| 1% cashback | Supermarkets Travel

|

Flights aren't included.

Find out more about which suppliers you can earn debit card cashback with.

Qualifying for cashback

You'll need to pay £500 a month into your Santander Edge current account to get cashback. Any interest paid, and payments between Santander personal accounts you’re named on won't count towards this. You also need to have 2 active Direct Debits on the account.

We’ll pay your cashback each month and it’s capped at £10 per month for essential spend and £10 a month for household bills.

We won’t charge you for using your Santander Edge debit card to withdraw cash and make payments in the local currency outside the UK. (We'll apply a 0% foreign currency conversion fee.)

It may take up to 3 working days for the 0% foreign conversion currency fee to be applied after you’ve opened or transferred to the Santander Edge current account. If you use your debit card outside the UK before then, the standard foreign currency conversion fee of 2.95% will apply. This fee is non-refundable.

We'll apply the current Mastercard exchange rate to any purchases or cash withdrawals you make in the local currency.

Please note that local banks may charge their own fees when you use one of their cash machines and you should make sure you understand what these are before making a withdrawal.

You can also send money to friends and family abroad from your Santander Edge current account with no extra fees from us for the international payment. The bank receiving the payment may still apply charges.

Have a look at the Fee Information Document (PDF - 128 KB) for more information.

Key documents

- Santander Edge current account Key Facts Document (PDF - 891 KB)

- Santander Edge current account Fee Information Document (PDF - 128 KB)

- General Terms & Conditions

To view these documents you may need to download Adobe Reader

You can apply if

- You’re over 18 and live in the UK permanently.

- you live in the UK permanently.

You may only hold a maximum of two Santander Edge current accounts, one in your own name and one in joint names.

Santander Boosts

Get rewards to give you a little boost when you bank with us.

All you need to do is sign up for Santander Boosts through your Mobile Banking app or in Online Banking and then you’ll be able to choose the offers you like and earn rewards with your favourite retailers.

- Earn cashback when you shop online at a wide range of retailers

- Receive vouchers and coupons for discounts on a variety of products and services

- Get offers personalised to your individual interests and hobbies

- Enjoy free gifts and enter prize draws

Ways to bank with us

24/7 banking on all your devices with Online Banking and our Mobile Banking app.

- Set up personalised account alerts.

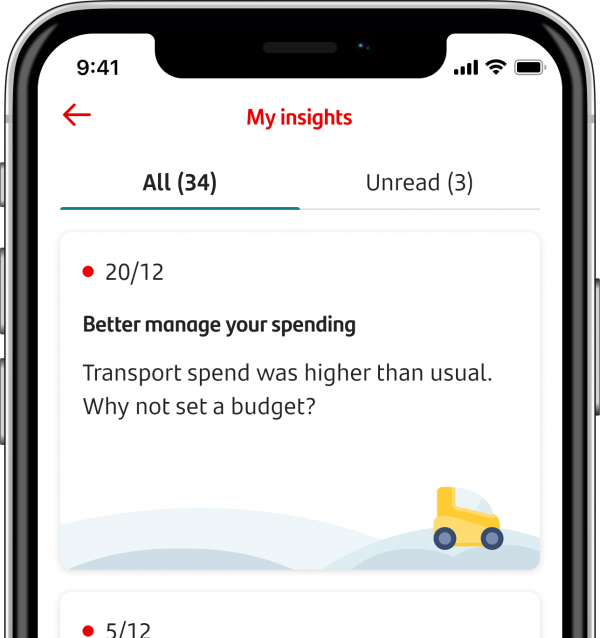

- Get personalised spend insights with My Money Manager

- Pay with your phone by linking your debit card to your Apple, Android or Samsung device.

Face-to-face support in branch and UK-based telephone support.

- Visit your nearest branch

- Telephone Banking

- Cash machines

- Post Office

Paper-free

This is a paper-free account which means:

- Your documents, statements and some of your letters will be sent as e-Documents to your secure inbox on Online Banking (unless you require documents in an alternative format, such as Braille).

- You'll need to provide us with an email address when you open the account as we’ll send you an email to let you know when a document is ready to view.

- Once the account has been open for at least 24 hours, you can update your account settings at any time to start receiving statements and other correspondence by post.

Security

Keep your banking details private and secure. For more information about our approach to security as well as more useful information to help you stop the threat of fraud, visit our fraud and security pages

How we manage scam claims

We’ll support you if you’ve fallen victim to fraud. Find out more about our approach to fraud

To earn interest with Santander Edge, you can apply for the Santander Edge saver account which pays 6.00% AER* / 5.84% gross** (variable) interest on balances up to £4,000 (includes 1.50% AER / 1.49% gross (variable) bonus rate for the first 12 months from opening).

- You’ll need to apply for the Santander Edge saver separately, after you’ve opened your current account.

- You'll need to apply through Online or Mobile Banking. If you're new to Santander or don't already use these, we'll send your log-in details within 7-10 days of your new current account being opened.

- You can have one Santander Edge saver for each Santander Edge current account you have. That means a maximum of 2 if you have both a single and a joint Santander Edge current account.

- The Santander Edge saver can only be held in a single name. If you have a joint Santander Edge current account, you can each have a Santander Edge exclusive saver in your own name.

- You’ll need to continue to hold a Santander Edge current account to stay eligible for exclusive products. If you stop being eligible, we may close or downgrade your exclusive product(s).

Learn more about the Santander Edge saver

* AER stands for Annual Equivalent Rate and shows what the interest rate would be if we paid interest and added it to your account each year.

** The gross rate is the interest rate we pay where no income tax has been deducted.

Rates may change and we pay interest each month.

Get access to the Santander Edge credit card when you have a current account

2% cashback (up to £15 a month) on your everyday spend with the Santander Edge credit card in your first year.

29.8% APR Representative (variable). A monthly fee applies. Credit subject to status.

Boost up your life

With cashback, discounts and special offers that match your interests. All you need to do is sign up for Boosts through your Mobile Banking app or in Online Banking and you’ll be able to choose the offers you like and earn rewards when spending at your favourite retailers

My Money Manager

If you’re trying to be better with your money, My Money Manager is designed with you in mind. Now, as well as banking on the go, our mobile banking app lets you get tailored insights into how you spend.

How do I switch to Santander?

Choose to switch to us when you apply, or anytime after opening a Santander account. We’ll do the hard work, like closing your old account and moving payments. It’s simple, reliable and stress-free.

Information correct as at 13th Jan 2025.