From today (Friday 28 March) customers looking to purchase or remortgage a home can borrow more from Santander UK. It becomes the first major lender to reduce residential affordability rates in response to the FCA’s call earlier this month for lenders to design their affordability rates to best meet their customers’ needs, in a market where interest rates are declining.

All residential affordability rates have been reduced by up to 0.75%, bringing them to the lowest levels since 2022.

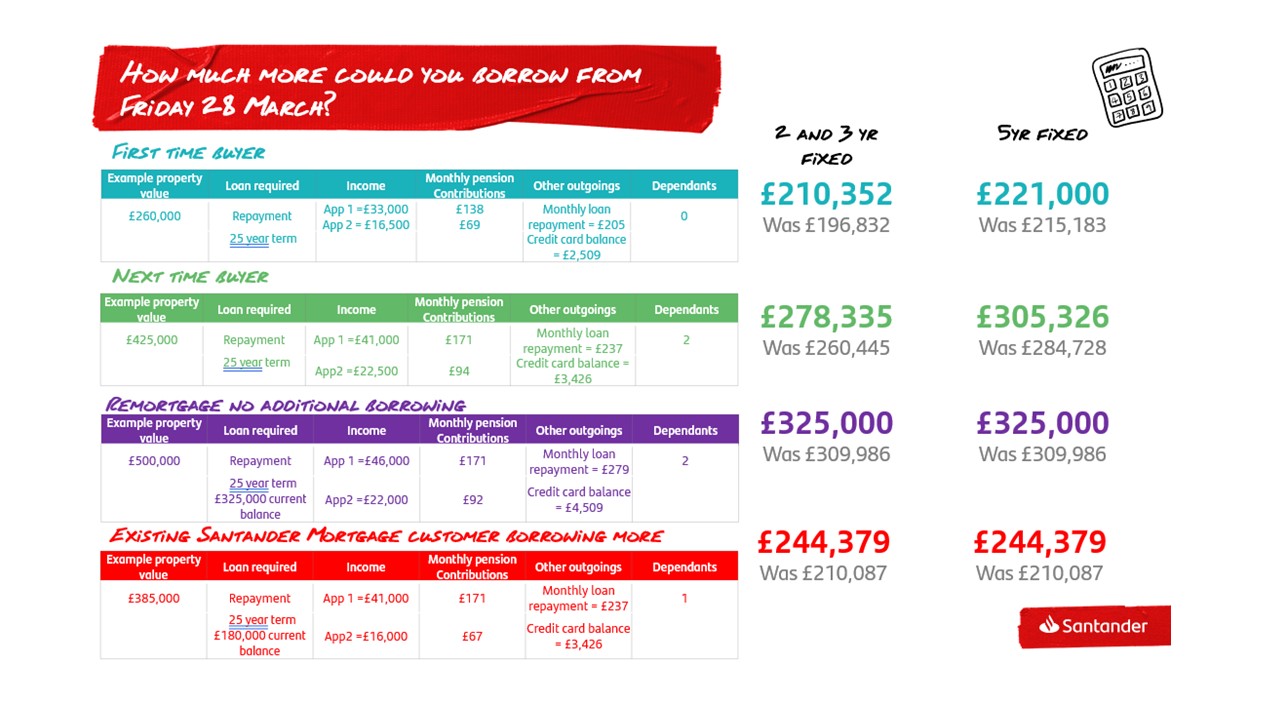

In real terms, this means that many customers applying for a residential mortgage from Santander UK can now borrow between £10,000-£35,000 more than yesterday, depending on their individual circumstances and subject to affordability checks and loan to income limits.

David Morris, Head of Homes, Santander UK said:

“Helping customers achieve their homeownership dream is a key priority for Santander, but we know that affordability constraints continue to bite. We’re thrilled to be the first major lenders to respond to the updated FCA guidance, alongside introducing a range of reduced mortgage interest rates today, fulfilling our role as a responsible lender while helping more customers to borrow what they need to release their home aspirations.”

*Source Santander UK, the above examples are illustrations only and mortgage affordability is assessed on an individual basis.

On Wednesday, Santander UK announced a new range of mortgage products with rate reductions of up to 0.15% for home movers and up to 0.08% for first-time buyers. More details on the new range can be found here.

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. At 31 December 2024, the bank had around 18,000 employees and serves around 14 million active customers, including 7 million digital customers via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM, STD US, BNC.LN) is a leading commercial bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage its unique combination of global scale and local leadership. Banco Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way.