Looking for a credit card that gives you a little back each time you pay?

The Santander Edge credit card offers cashback on purchases – and helps keep you in control with online banking and security features.

2% cashback (up to £15 a month) on all purchases for the first year

1% cashback (up to £15 a month) on all purchases after the first year

No foreign exchange fees on purchases overseas

A £3 monthly fee applies

What you need to apply

- A Santander personal UK current account, and you’ll need the account number and sort code during the application

- To be aged 18 or over and a permanent UK resident

- To have an income of £10,500 or more a year

- Don't already have a Santander Edge credit card

All credit is subject to status and credit checks.

Sorry, cahoot, Cater Allen and Business Banking current accounts are not eligible. If you close your current account, you stop earning cashback and we’ll stop charging the monthly fee.

Representative example

Representative 29.8% APR (variable)

Assumed credit limit £1,200

Purchase rate 23.9% p.a. (variable)

Monthly fee £3

Cashback calculator

Get an estimate of how much cashback you could earn based on your spending.

Here are some of the great features you get with all Santander credit cards

Free account alerts

Keep safe and in control of your card.

We’ll send you account alerts when you’re near your credit limit to help you avoid fees. We can also make you aware of certain activity on your account. You can manage your alerts settings at any time in Online Banking. If you need more help, please contact us or visit your local branch.

Boost up your life

With cashback, discounts and special offers that match your interests. All you need to do is sign up for Boosts through your Mobile Banking app or in Online Banking and you’ll be able to choose the offers you like and earn rewards when spending at your favourite retailers

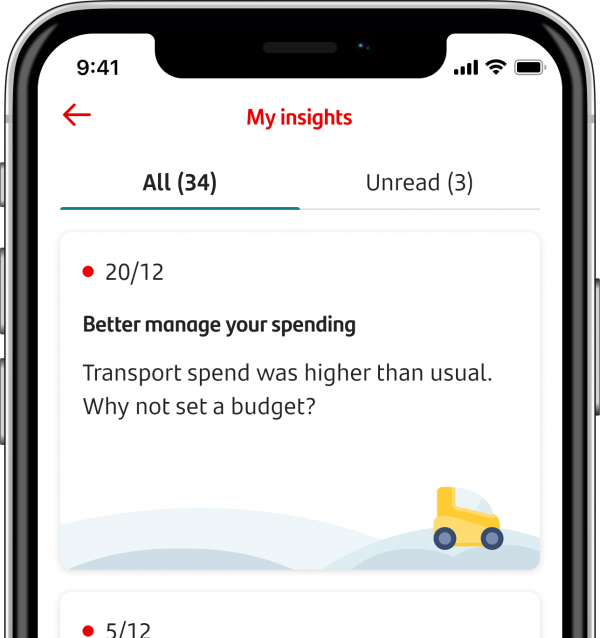

My Money Manager

If you’re trying to be better with your money, My Money Manager is designed with you in mind. Now, as well as banking on the go, our mobile banking app lets you get tailored insights into how you spend.

Section 75 protection

Buy with confidence - with protection under the Consumer Credit Act for some purchases.

Up to 56 days interest free

Get up to 56 days to pay, when you clear your balance in full each month.

Mastercard Priceless™

Enjoy unforgettable experiences and valuable offers in the cities where you live and travel.

Account fee

The fee for this card is £3 a month.

We will add the fee to your credit card balance each month.

Cashback

- 2% cashback on purchases for the first year

The maximum amount of cashback you can earn each month is £15.

This means you earn cashback on the first £750 you spend on your card each month. - 1% cashback on purchases after the first year

The maximum amount of cashback you can earn each month is £15.

This means you earn cashback on the first £1,500 you spend on your card each month.

Some transactions aren't eligible. Cashback will be paid into your account on the same day as your statement date.

If we see you’ve closed your Santander current account, you’ll stop earning cashback on your Santander Edge credit card, and we’ll stop charging you the monthly fee. We’ll give you 60 days to open a new current account before we stop your cashback and fee. If you open a new Santander current account after 60 days, we won’t reinstate the cashback or the fee on your card.

Purchases and cash withdrawals abroad

- You won’t be charged foreign transaction fees on purchases and cash withdrawals made abroad in the local currency. If you choose to pay in sterling, the retailer or bank will handle the conversion and may charge you a fee.

- A cash transaction fee of 3% (minimum £3) will be charged on all cash withdrawals, including those made abroad. You’ll be charged 29.9% p.a. interest on the cash you take out from the day it’s withdrawn.

Earn cashback quicker with additional cardholders

You can have up to 3 additional cardholders on your credit card. This means you could earn cashback more quickly on your account.

The additional cardholders must be close family members who live at the same address as you. You will be responsible for the use of and payments on the additional cards. If the additional cardholder isn't a Santander customer we may ask for ID for them.

Experience the world with Mastercard

- Mastercard is accepted at more than 100m places worldwide so you can use your card wherever you see the Mastercard sign at home and abroad.

- Priceless.com is available exclusively to Mastercard cardholders and offers access to incredible experiences and valuable everyday offers in the cities you live and travel to. Fuel your passions with one-of-a-kind, customised experiences, from culinary arts and culture, to music, sports and more. Register online at priceless.com to receive regular updates on how you can access these exclusive experiences.

- To be one of the first to know about events and experiences and participate in prize draws, make sure you’re opted in to receive marketing messages from Santander.

The Santander Edge credit card gives you complete control with Mobile Banking.

Card controls

You can use Mobile Banking to help you take control of your card account.

- Never worry about forgetting your PIN again – it’s ready to view any time in Mobile Banking.

- You can temporarily freeze your card if you think you’ve lost it or it’s been stolen. You can unfreeze it if you find it again. This saves you the hassle of cancelling it and waiting for a new one.

- You can block certain transactions such as gambling, online, international and contactless to protect yourself and your spending.

- Your contactless card allows you to pay for things that cost up to £100, but you can lower this limit using our chat service in Mobile or Online Banking.

Minimum repayment

You must make at least the minimum repayment each month towards your credit card balance. The amount and due date will be on your statement.

Direct Debits – never miss a payment

Setting up a Direct Debit means you’ll never miss a payment.

There are 3 types of Direct Debit to choose from:

- Full payment: pay off the entire balance each month.

- Minimum payment: a percentage of your balance you must pay each month to keep your account up to date.

- Fixed payment: an amount that you decide to pay off each month.

Contactless payments

All our credit cards are contactless, so making payments is secure, easy and convenient. You can also link your Santander credit card to your phone or smartwatch and pay wherever you see the contactless symbol. We support: Apple Pay, Google Pay, Samsung Pay and Garmin Pay. Find out more

Key documents

- Santander Edge credit card Key Facts Document (PDF - 995 KB)

- General Terms & Conditions (PDF - 215 KB)

- Summary box (PDF - 106 KB)

- Cashback terms (PDF - 56 KB)

When you apply, we’ll carry out a credit check. This will help us to decide the credit limit we can offer. We’ll tell you your credit limit once your application has been accepted.

Borrowing options

A credit card may not always be the best solution for you. We have other borrowing options such as overdrafts and personal loans. Plus there are additional loans for our existing mortgage customers.

Fraud protection

Our priority is to help protect you from falling victim to fraud or a scam. We have systems in place to detect unusual transactions on your account and online security measures to keep your money safe. Find out more

Information correct as at 22 January 2025.